These 19 Fortune 100 Companies Paid Next to Nothing—or Nothing at All—in Taxes in 2021 - Center for American Progress

US federal income tax return concept with a close up image of IRS 1040 form with some notes, calculations stickers highlights and a blue pen. Versatil Stock Photo - Alamy

A USA Federal Income Tax Form 1040 is Seen with Four One-hundred Dollar Bills To Represent Taxes To Be Paid or a Tax Refund Editorial Image - Image of refund, paper: 269793265

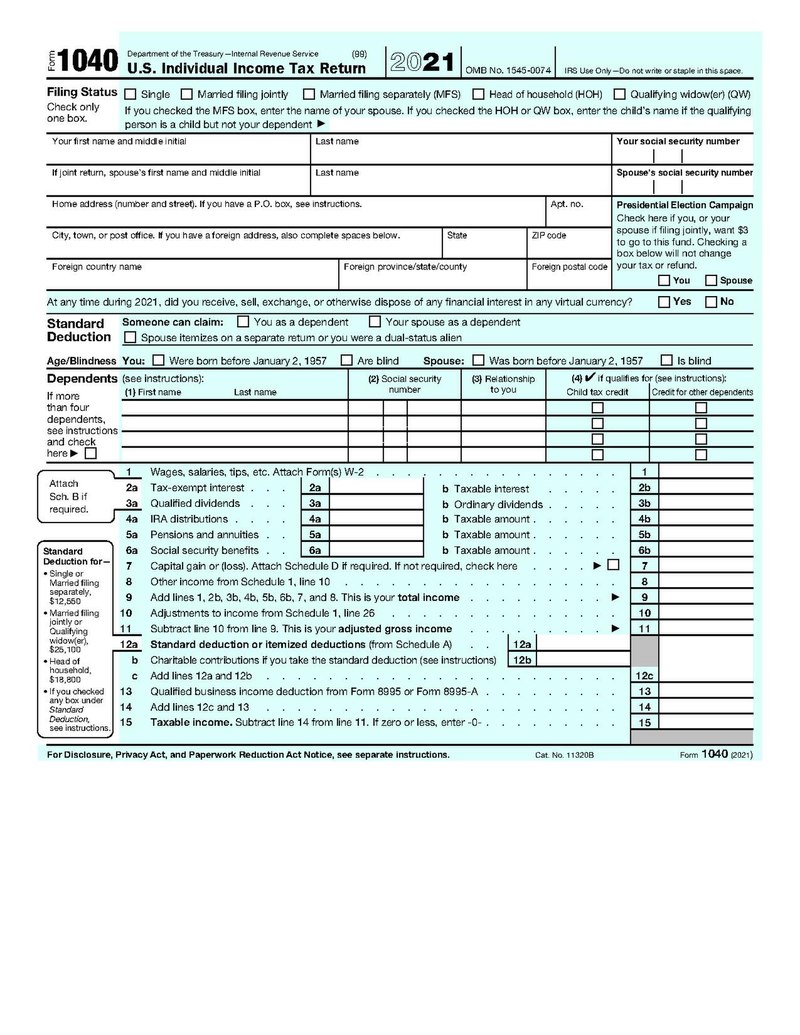

:max_bytes(150000):strip_icc()/Form1040-SR2022-b0b21772ee8a4be689090dccb27bfec0.jpg)

:max_bytes(150000):strip_icc()/Form1040copy-7af98beb63114d4ab3f7a999ba1f3608.jpg)